How the weakening US dollar is reshaping global economies

As the US dollar continues to lose steam against major currencies, investors and policymakers around the globe are closely monitoring its potential to destabilise markets, while businesses tell of a mixed impact.

(Illustration: CNA/Nurjannah Suhaimi)

This audio is generated by an AI tool.

Despite higher prices across the United States, Mr Kenny Lim, 33, felt willing to spend a bit more during a recent trip to Los Angeles, thanks to the weaker currency.

The programme executive said that, compared to his time living in the US three years ago, the cost of dining out and shopping was more affordable this time around because of the relative strength of the Singapore dollar.

"The menu prices at The Cheesecake Factory have increased, but due to the weakened US dollar, it's a bit more affordable and easier for me to decide what to eat," Mr Lim commented.

"I do monitor the currency rates, especially when there's big news happening in the US market, and I would see if there's any opportunity to exchange US dollars," he added, noting that cards tied to multi-currency money-changing application YouTrip, for instance, provide more favourable rates.

Similarly, when 35-year-old Singaporean cybersecurity analyst Francisco visited the US earlier this year, he was surprised to find that the notoriously expensive New York City didn't feel quite as punishing on the wallet as it used to be.

Mr Francisco, who declined to be identified by his full name because he works for a company with a strict media policy, found the shopping and dining there to be "slightly more affordable" compared to previous trips, so he could spend more.

"It was easier to loosen purse strings knowing that the exchange rate was more favourable," he said.

For instance, when he rented a car for his trip, he found that a full tank of petrol cost US$50 (about S$64) compared to S$200 in Singapore.

While he and Mr Lim are benefiting from the weakening US dollar, the same cannot be said for Singaporean robotics company Augmentus, which has been negatively affected by the situation.

For businesses, especially importers, the weakening US dollar is often viewed as good news.

When the currency begins to decline, it typically means that importing products or services priced in the US dollar is cheaper for Singaporean companies, which can lower costs and improve margins for importers.

Although this may benefit some companies, others face higher costs, pricing issues or uncertainty, so they end up having to rethink how they manage their money and supplies.

Mr Daryl Lim, 30, chief executive officer and co-founder of Augmentus, said that the weakening US dollar has been a challenge for his company.

As a tech startup, the weakening currency does not significantly affect Augmentus' pricing or procurement.

However, it has a major impact on the company's fundraising, since most of its capital is raised in US dollars, meaning it now receives less in Singapore dollars after converting those funds.

"A lot of our funding is in USD (US dollar), so the weakening dollar has a big impact on us. Last year, 1 USD was 1.35 SGD (Singapore dollar); now it is about 1 USD to 1.28 SGD. So, it's about a 5 to 6 per cent drop. And it's pretty significant."

Augmentus has offices in both Texas and Singapore, but around 60 per cent of its operating expenses are in Singapore dollars. As a result, revenue received in US dollars from the company's clients in the US effectively shrinks by about 5 to 6 per cent when converted, due to the weaker exchange rate.

Mr Lim said: "People think that it's cheaper now to do business in the US because of the currency weakening. However, for us ... a significant portion of our funds is in USD. We receive money in USD due to the entire venture capitalist ecosystem and from our investors as well, so it doesn't apply to us."

The US dollar has long been regarded as the ultimate safe haven in times of geopolitical or financial turmoil. However, on June 13, even as geopolitical conflicts were roiling across the world, the greenback sank to its lowest in more than three years.

The US Dollar Index (DXY) fell to about 97.8, its lowest level since March 2022, representing a decline of roughly 9 to 10 per cent since the start of the year.

The DYX illustrates the strength of the US dollar in relation to six major world currencies, namely the Canadian dollar, the euro, Swiss franc, Swedish krona, British pound and Japanese yen. If the index rises, it means the US dollar is gaining strength; if it falls, the US dollar is weakening.

Experts who spoke to CNA TODAY attributed the greenback's weakness largely to the US' slowing growth in comparison to other advanced economies.

Mr Mahesh Sethuraman, Singapore chief executive officer of international global investing firm Saxo, said that even though there have been moments since the 1980s when the US dollar weakened and analysts warned of the "demise of the dollar", this time feels "a bit more serious than past ones" because the fiscal deficit of the US has become increasingly unsustainable.

Mr Sethuraman pointed to the pressure stemming from the US' twin deficits:

- The federal budget deficit reached US$316 billion (S$405.5 billion) in May (indicating government spending outweighing revenue)

- The current account deficit hit US$303.9 billion in the fourth quarter of 2024 (indicating imports outweighing exports)

These have led to a persistent strain on the dollar.

The Congressional Budget Office (CBO) stated that the US was projected to run a fiscal deficit of US$1.9 trillion in 2025, amounting to 6.2 per cent of the country's gross domestic product (GDP).

The CBO is a non-partisan agency that provides independent economic and budgetary projections to help inform US congressional decision-making.

Mr Sethuraman said: "Each dollar demise cycle is understandable. But this time, on top of that, you also have unpredictable behaviour from the US and not just towards so-called enemies but even allies."

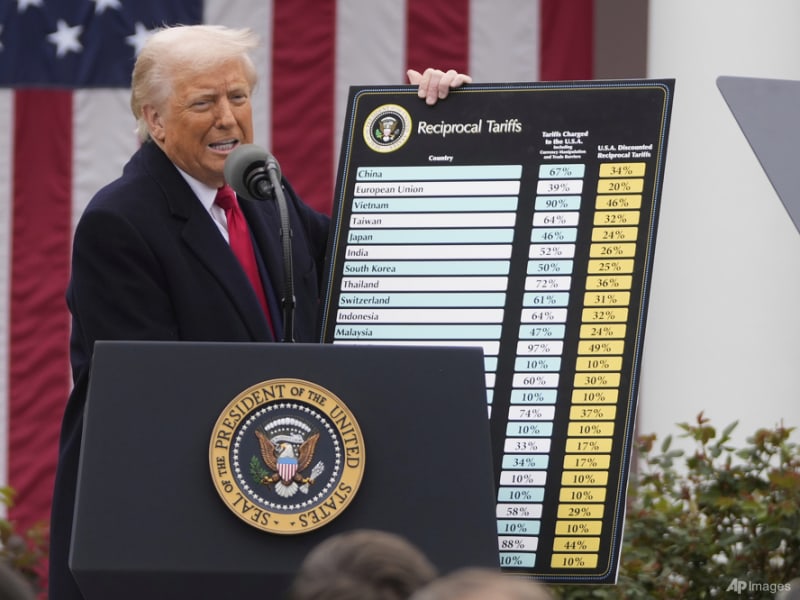

Shortly after returning to the White House in January, US President Donald Trump introduced a fresh round of tariffs on imports under his "Liberation Day" agenda, a move that has rattled investor confidence and added to concerns about US trade policy.

Echoing Mr Sethuraman's sentiments, Ms Eileen Chia, who is regional head of corporate advisory at DBS bank's global financial markets, said that the US dollar is coming under pressure due to growing concerns over American fiscal management and policy direction.

"Investors have also been rotating into alternative safe havens like gold," she added.

At the same time, she noted that the European Central Bank is positioning the euro to play a bigger role globally, which is further weighing on the dollar.

Besides the US' slowing economic growth, the US dollar's decline has been driven by several other factors, including growing expectations that the US Federal Reserve will begin cutting interest rates later this year, despite the US labour market performing better than expected in May.

Analysts have noted that the dollar's typical rally during times of global instability has been muted. Following the latest outbreak of fighting between Israel and Iran, the dollar gained only 0.25 per cent, a sign that its traditional role as a safe-haven currency may be waning.

Mr Hugh Chung, chief investment officer of investment platform Endowus, said the weakening of the dollar can be seen as a loss of confidence in US exceptionalism.

This refers to the ability of US corporate earnings to grow faster than those of the rest of the world, driven by innovative technology companies and productivity gains, while being backed by resilient consumption and a solid labour market.

"Coming into 2025, however, we may be seeing the confidence in US exceptionalism erode as investors worry about tariff wars and their implications for the US economy and US exceptionalism," Mr Chung added.

HOW THE US DOLLAR BECAME THE GLOBAL CURRENCY

The US dollar plays such a big role on the international stage because it is the official currency not only for the US but also for several other nations such as Timor-Leste in Southeast Asia.

It functions as the global currency, meaning it can be freely used or exchanged for another currency inside or outside the US.

The US dollar is also the world's dominant reserve currency, held by central banks globally for international trade and financial stability.

A reserve currency is a foreign currency that countries hold in significant quantities to conduct global transactions, settle debts and support the value of their own currencies.

Before the US dollar was used as the global currency, the Federal Reserve Act of 1913 established the US Federal Reserve Bank to address the unreliability and instability of a currency system previously based on banknotes issued by individual banks.

At the time, most developed countries pegged their currencies to gold as a way to stabilise currency exchanges.

However, when World War I began in 1914, many countries stopped using the gold standard to print more paper money to finance the war, which diminished the value of their currencies.

Britain endeavoured to maintain the gold standard to uphold its status as the world's leading economic and financial power, but had to start borrowing money by the third year of the war.

Separately, the US became the primary lender to other nations, with many countries buying US bonds denominated in dollars.

When Britain ultimately relinquished the gold standard in 1931, it adversely affected global traders who depended on the British pound, paving the way for the US dollar to take over as the world's main reserve currency.

Then, before World War II, the US supplied weapons and goods to Allied countries, most of which paid for them in gold. As a result, the US ended up holding most of the world's gold by the end of the war.

This made it difficult for other countries to return to the gold standard, since their gold reserves had been depleted.

Therefore, in 1944, delegates from 44 Allied countries gathered in the US – in Bretton Woods, New Hampshire – to establish a system for managing foreign exchange that would not disadvantage any nation.

After World War II ended in 1945, the Bretton Woods system effectively pegged major currencies to the US dollar, which was in turn backed by gold.

Even after the system collapsed in the 1970s, when the US suspended the convertibility of the greenback to gold, the dollar remained dominant, buoyed by the strength of the US economy, deep capital markets and the country's political stability.

Today, the US dollar accounts for nearly 60 per cent of global foreign exchange reserves, the International Monetary Fund (IMF) stated, and it is used in nearly 87 per cent of foreign exchange-related transactions.

Much of the world's oil and commodities are also priced and traded in US dollars, cementing the greenback's status as the so-called petrodollar.

SOFTENING GREENBACK HAS A "MIXED IMPACT"

As the US dollar continues to lose steam now against major currencies, investors and policymakers around the globe are closely monitoring its potential to destabilise markets, shift trade balances and reorder long-standing financial norms.

Portfolio manager Erik Wong, who is head of foreign exchange at Lion Global Investors, an asset management arm of Singapore's OCBC bank, said that in light of prolonged US-China trade tensions and rising protectionism, a softer US dollar has "a mixed impact" on Singapore's economy.

The Singapore dollar tends to strengthen when the greenback weakens, and the Singapore dollar has outperformed most Asian currencies this year due to its safe-haven appeal, he added.

As such, the Singapore dollar's strength has eroded the price competitiveness of the country's exports, especially against regional peers such as Malaysia and Vietnam. And so, leading export sectors such as electronics, logistics and pharmaceuticals are feeling the pressure to reprice or shift production.

Ms Chia from DBS said that with the US dollar playing an integral role in trade invoicing and corporate funding worldwide, any significant volatility might stress institutions that have currency mismatches.

For instance, companies that earn revenue or hold assets in US dollars but have to repay loans in stronger currencies may find themselves exposed to financial losses as their dollar holdings lose value.

Mr Wong from Lion Global Investors said: "A stronger SGD helps moderate imported inflation, softening the impact of global food and energy price increases. With supply chains fragmenting, the overall effect depends on how quickly firms can adjust operations and reconfigure trade routes."

Mr Cameron Systermans, head of multi-asset at global consulting firm Mercer Asia, said that a slumping US dollar usually benefits Asian and emerging markets, because investors will move their funds to these markets given a weakening greenback.

"Although looking forward, this tailwind may be partially offset by the impact of higher US tariffs," he added.

Trade aside, given Singapore's substantial reserves and investments in US dollars, a weakening greenback naturally raises concerns about the potential impact on its national wealth.

As of March 31, 2024, the Official Foreign Reserves managed by the Monetary Authority of Singapore (MAS) was S$498 billion and the size of state investor Temasek's net portfolio value was S$389 billion. The size of the government's funds managed by GIC, the nation's sovereign wealth fund, is not publicly published but it has been reported that GIC manages more than US$100 billion (S$128.5 billion).

Mr Alex Low, the principal investment specialist at investment and wealth management company PhillipCapital, said that even though currency translation effects can influence reported returns, especially on US dollar-denominated assets held by GIC and Temasek, their globally diversified portfolios and long-term investment horizons provide a natural hedge.

"These institutions typically adopt long-term strategies with risk-adjusted performance benchmarks."

He added that their robust hedging frameworks and multi-asset allocation strategies help manage exposure to currency fluctuations effectively.

A weaker US dollar may also influence monetary policy calibration for MAS, Mr Low suggested. Singapore lets its dollar move within a controlled range against a basket of key trading partner currencies, including the US dollar.

If the greenback stays weak for a long time, it could affect this balance and that may lead Singapore's central bank to adjust its currency policy.

"MAS has already responded with a gentler slope of SGD appreciation to strike a balance between controlling inflation and supporting export competitiveness," Mr Low said.

Although GIC and Temasek may book short-term translation losses when converting US dollar gains into Singapore dollars, the weaker greenback also presents opportunities, making US assets more attractively priced for future acquisition, Mr Low said.

As for the impact of the US dollar's slide on Singapore's reserves, analysts said the effects are likely to be limited in the short term and must be seen in the context of broader structural shifts.

The weakening US dollar reflects more profound questions about long-term US economic policies rather than an immediate threat to Singapore's holdings, they added.

Mr Song Seng Wun, economic adviser at CGS International Securities Singapore, said that "nothing changes overnight" and the dollar remains deeply embedded in the global system.

Mr Sethuraman said: "Even as the dollar weakens, the question remains of how much is it going to weaken? Regardless, I don't think that's going to change the fundamental life of Singaporeans."

As for the economy, a weaker US dollar and a stronger Singapore dollar can affect the kind of businesses Singapore attracts, especially in manufacturing, which can have an impact on hiring in the sector.

"We do have an economic problem and it is not because of the dollar weakness. Instead, it is what's causing the weakness, which is the unreliability and unpredictability of US international trade policies," Mr Sethuraman added.

"What the market is telling the world is that if the US remains as unreliable as it is now, then we need to think of alternatives."

WILL THE GREENBACK CONTINUE ITS GLOBAL REIGN?

Recent trends may suggest the US dollar is losing its grip as the global currency, but it remains firmly entrenched as the world's dominant reserve currency with no credible alternative on the horizon, most of the analysts said.

"It's very difficult because the US dollar is still the currency of trade for the global economy. It's still the reserve currency for the world," Mr Song said.

Agreeing, Mr Wong from Lion Global Investors said the dollar remains dominant but "its status is being questioned more openly than at any time since the end of Bretton Woods".

He also noted a growing trend of diversification, with investors and central banks increasingly turning to gold, the euro and, in some cases, the Chinese yuan as alternative stores of value.

"However, no alternative currently matches the depth, liquidity and legal protections that the US dollar provides," Mr Wong continued. "De-dollarisation or diversification is real, but it is happening slowly and primarily as a defensive measure."

De-dollarisation refers to the gradual move by countries and institutions to reduce their reliance on the US dollar in trade, finance and reserves, often by using alternative currencies or assets such as the euro, yuan or gold.

Mr Song said that this shift away from the greenback is unlikely to occur in the near future or even within the next 40 years. Such a transition would require a complex alignment of multiple economic and geopolitical factors.

"(It) would require the US to gradually lose its role as a modern economy in the world as others increase their dominance.

"It's clearly contingent upon the role the US economy plays in global trade and global finance. If this role were to diminish, the US dollar would also diminish alongside it as an economic superpower," Mr Song added.

Several currencies appear poised to challenge the US dollar's dominance, but taking over the role of the global reserve currency is far from straightforward, the experts said.

Mr Low believes the euro is the "closest contender", but it remains constrained by fragmented fiscal policies.

Even though the European Union (EU) has the power of a large economy, it comprises 20 different countries with varying debt levels and fiscal policies, Mr Sethuraman said.

"For example, I am comfortable lending to Germany, but I may not be comfortable lending to Greece … (The EU doesn't) have the advantage of a unified one-country system like the US.

"There is no obvious substitute for the dollar as a global currency at the moment," Mr Sethuraman added.

As for the Chinese yuan, which has gained some traction in bilateral trade, the experts said that it lacks capital account convertibility, meaning it is not easy to move money in and out of China freely. This makes it a less viable candidate for global reserve status.

"China clearly does not want its currency to be at the mercy of trading floors in New York, London, Tokyo or even Singapore," Mr Song said. "So I think it is being very, very careful about how much of the Chinese currency is allowed to circulate abroad."

As to whether the Singapore dollar could ever become the global currency, given its strength and status as a safe haven in the region, the analysts said that it is unlikely to happen due to the country's small size.

Mr Isaac Lim, the chief market strategist at digital brokerage Moomoo Singapore, said it is "highly unlikely" for the SGD to match the USD in the short term, but "even if it hypothetically did, this wouldn't necessarily indicate equal economic strength between the two countries".

The US constitutes 25 per cent of global GDP and its currency is used in nearly 87 per cent of all foreign exchange-related transactions, Mr Lim noted.

He also said that the US is a free and open economy highly attractive to foreign investors, with a liquid financial system and a currency that remains the most widely accepted and easily convertible in the world.

"While the SGD has gradually appreciated, supported by strong trade surpluses and prudent fiscal and monetary policies, it would take a really long time for the SGD to ever match up to the factors that would allow for it to be the global reserve currency."

SHORT-TERM GAIN, LONG-TERM IMPLICATIONS FOR BUSINESSES

The impact of a weakening US dollar on businesses is mixed, offering both opportunities and challenges, and is far more nuanced than it might initially appear, the experts said.

"Companies with USD-denominated imports will benefit from cheaper input costs and improved competitiveness, while firms holding USD debt will enjoy lower debt costs," Ms Chia from DBS said.

"With stronger SGD purchasing power, businesses with ample cash may find this an opportune time to expand overseas and make foreign acquisitions at relative discounts."

However, she said that export-oriented businesses such as manufacturers and commodities traders that typically invoice in US dollars will see their margins squeezed.

To mitigate such risks, Ms Chia said her team has been advising clients to proactively hedge their exposure to the US dollar so that they protect the value of their incoming payments.

This includes matching foreign currency inflows with outflows, or using financial instruments such as options or forward contracts to lock in present exchange rates and protect themselves against future declines in the US dollar.

Mr Ken Lin, managing director of steel process centre Kawarin Enterprise, said the currency situation had been a mixed bag for his business, offering some benefits while also creating operational challenges.

The weaker greenback has had a "noticeable impact", particularly in areas where the company transacts in US dollars, for instance, when procuring raw materials such as steel, which are usually priced in US dollars.

On this aspect, there has been some "short-term relief" for his business, though it is also dependent on suppliers' pricing behaviour and contract structures.

At the same time, the exchange rate movements have added a layer of complexity to pricing discussions, Mr Lin added.

"We've had to re-evaluate certain quotations and consider hedging for longer-term contracts. In some cases, clients are expecting more competitive pricing from us due to the stronger Singapore dollar versus the US dollar."

Likewise, Mr John Kong, who is involved in the manufacture of steel building materials and imports steel from the region, said that the weakening US dollar is not as beneficial as one might think.

"(It) will result in short-term gains but it also has long-term implications. You might incur significant losses if you don't manage it well."

Mr Kong added that even with a weaker US dollar, the company must be agile and use the situation to its advantage, because its projects depend heavily on timing.

"I may have a project that takes two years to complete, so I need to plan carefully when and how to hedge the cost of steel.

"You won't buy anything until near delivery, maybe a year or six months before, because you don't know the level the rates will be. But by then, you've already committed to the project pricing based on a certain USD rate. So again, it's a gamble," he explained.

Mr Pierre Yap, a food manufacturer in Singapore who procures his supplies in US dollars, said he has felt the negative impact of the weakening dollar acutely.

For his overseas suppliers, they have seen their earnings fall when converting US dollar revenues back to their home currencies, due to the weaker greenback.

This squeeze on margins has prompted many suppliers to renegotiate prices, leading to increased procurement costs on his end.

He told of one supplier, contracted to deliver a fixed quantity of products over five months at a set US dollar price, who began pushing for renegotiation when the US dollar weakened.

As the US dollar continued to decline, other international buyers were willing to pay more for the same goods, which added pressure on him to do the same.

"Either we pay more in US dollar terms or the supplier will supply other countries and void our contract," Mr Yap said, adding that the price of procurement has risen from US$13 to US$15.40 in three months.

LOOKING AHEAD

Mr Systermans from Mercer Asia said that although the weaker US dollar might typically encourage consumer spending since imported goods have become cheaper, this has not led to a strong surge in demand so far.

This is likely a reflection of consumers being more cautious about the overall economic outlook at home and internationally.

For those who have investment portfolios with US-denominated assets, Mr Lim from Moomoo Singapore said the key is not to panic.

"Dollar-cost averaging into US assets still makes sense, particularly for quality companies with strong fundamentals and global earnings."

This means investing a fixed sum each month into US investment assets such as stocks and bonds and as the US dollar weakens, the same investment sum will be able to purchase a higher amount of assets and vice versa.

At the same time, he suggested that investors could consider increasing their exposure to other currencies or regions that may benefit from a weaker US dollar.

Mr Chung from Endowus agreed, adding that gold may be an option: "With concerns over USD stability, rising fiscal debt and geopolitical concerns, gold can play a role in a portfolio as a store of value."

Mr Lim said: "Additionally, there is now a growing consensus that gold could very well be the only true risk-free asset in the markets."

Whether investors are looking to hold or sell their gold depends on the "original intent" of their investment, Mr Lim added.

"For those who purchased gold as a long-term hedge, it remains a sound defensive asset.

"However, if gold now represents a disproportionately large share of the portfolio, some rebalancing may be warranted to manage risk exposure."

Mr Lim also said that other precious metals such as silver and platinum, as well as commodities such as oil, may deserve attention.

Investment managers said that their savvier clients are increasingly looking beyond traditional safe-haven assets as well.

"We are seeing complementary interest in alternatives such as short-duration bonds, multi-currency income funds and tokenised assets," Mr Low from PhillipCapital said.

Bitcoin and other digital assets are also gaining traction among younger and tech-savvy investors, but "their volatility and regulatory uncertainty currently limit their safe-haven appeal", he added.

As a rule of thumb, investors should focus less on reacting to short-term currency swings and more on building resilience through diversification, Mr Chung from Endowus advised.

"Rather than worry about short-term fluctuations in currency, investors should consider whether the funds and underlying assets they own are ones that will accumulate wealth in the long term."